Which of the Following Best Describes a Misrepresentation

C loss of a business license. B It is illegal to be involved in any activity of boycott coercion or intimidation that is intended to restrict fair trade or to create a monopoly.

When salespeople loosely describe their product or service in glowing terms those statements can be relied upon by the potential buyer.

. Depending upon the circumstances such clauses may be enforced even if the party who wants to sue for breach did not read the clause. Misrepresentation is issuing publishing or circulating any illustration or sales material that is false misleading or deceptive as to policy benefits or terms the payment of dividends etc. A an agency violation b an innocent mistake c unethical but not illegal d an accepted practice in the industry.

Factual misrepresentation are minor false claims while puffery are false claims that make significant claims about a products effectiveness. D a voided contract and loss of commission. Which of the following best describes the difference between joint life and joint and survivor annuity payment options.

An intentional omission of material information on the part of the insured. An opinion cannot be a misrepresentation because it is not a statement of fact. Which of the following best describes a misrepresentation-Issuing sales material with exaggerated statements about policy benefits Correct.

Any misrepresentation by the insured. Which of the following terms best describes Kielys actions. If someone relies on another persons opinion and suffers.

Parties can use an entire agreement clause to protect only against innocent and negligent misrepresentation. What best describes misrepresentation. Rescission is not possible for innocent misrepresentation.

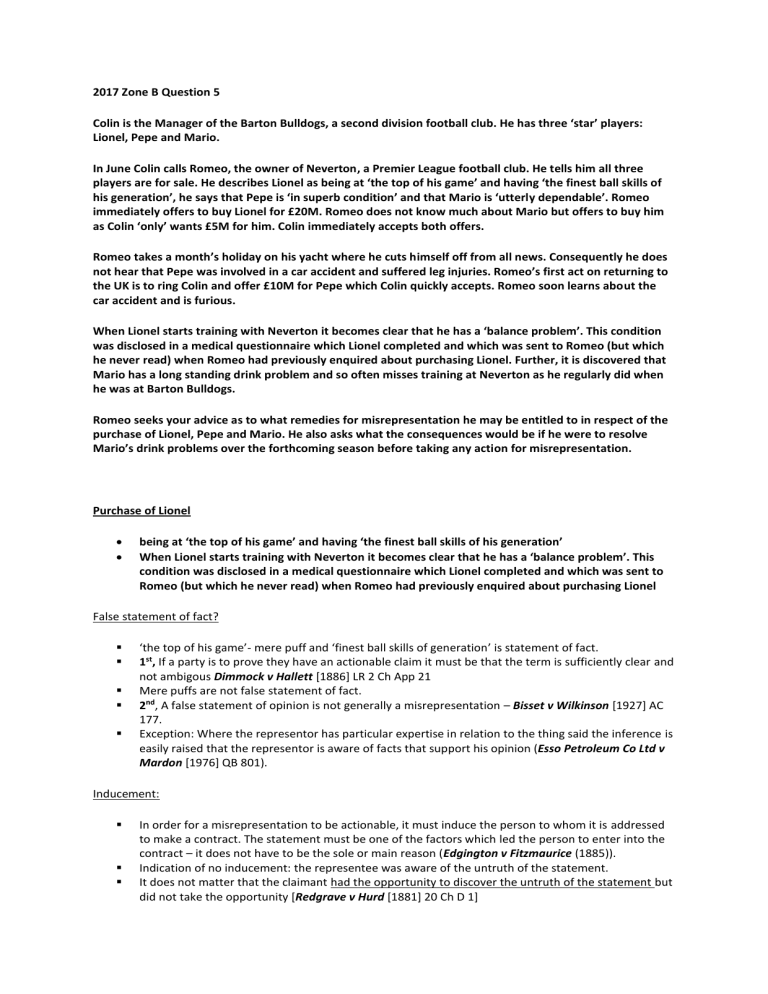

There are three types of misrepresentation in contract law. A misrepresentation can be a false assertion of fact that induces persuades a party to enter into a contract but it need not be an assertion about an important material fact. A failure to disclose known facts.

It is important to understand that all three types of misrepresentation is a misconstrued fact not an opinion. A an extended contract and protracted compensation. In join life option the benefits stop after the first death.

Which of the following best describes Michaels scheme. The intentional act of deception misrepresentation or concealment in order to gain something of value is. Three Types of Misrepresentation.

For fraudulent misrepresentation if proved the buyer may be entitled to punitive damages in addition to the remedy of rescission and damages in tort. Which of the following statements about bribery is true. A statement intended to distract mislead or deceive a party to a contract.

Guilty of misrepresentation B. Product liability may arise from a careless act in the manufacture of a product or carelessness in the design of a product or a careless failure to warn of the risks associated. A voided contract and loss of commission.

B issuing sales material with false statement about policy benefits. O all of the above. Misusing company assets C.

A Misrepresenting the true nature or facts of a policy or its benefit in order to induce a policyholder to surrender one policy and replace it with another is illegal. Which of the following statements about misrepresentation is most likely true. Misrepresenting facts to a buyer might result in.

The insured was severely injured in an auto accident and after 10 weeks of hospitalization died from the injuries. Innocent misrepresentation which of the following is. MISREPRESENTATION - Misrepresentation is a scenario when a salesperson provide incorrect information about the product to customers while negotiating the sales deal.

M isrepresentation is issuing publishing or circulating any illustration or sales material that is false misleading or deceptive as to the policy benefits or terms the payment of. There are three types of misrepresentationsinnocent misrepresentation negligent misrepresentation and fraudulent misrepresentationall of which. This includes oral statements.

A factual misrepresentation is demonstrably false while puffery is a statement about the quality of a product that cannot be disproven because of its general nature. An insured purchased a 15-level term life insurance policy with a face amount of 100000. Improper use of services or actions that are inconsistent with acceptable business or medical practice is.

Altering medical records to receive more reimbursement. You do not need to disclose latent defects in real estate. The statement about misrepresentation is most likely true - Even if the salesperson misrepresentation statement is made incorrectly many courts will award damages to the customer.

A statement that is not guaranteed to be true. If a real estate agent knowingly makes a substantial misrepresentation of the likely value of real property it is. Which of the following best describes a misrepresentation.

Michael a medical provider performs an appendectomy a procedure that is supposed to be billed as one code. If an insured purchases an insurance policy with a large deductible what risk management technique is the insured. Instead he intentionally submits two codes for the same procedure one for an abdominal incision and one for removal of the appendix.

The policy contained an accidental death rider offering a double indemnity benefit.

Misrepresentation Problem Question

Unreliable Narrators In First Person Writing Narration Help Writing First Person Writing Narrator

Comments

Post a Comment